Industrial Revolution and Urban Growth

Population Shift:

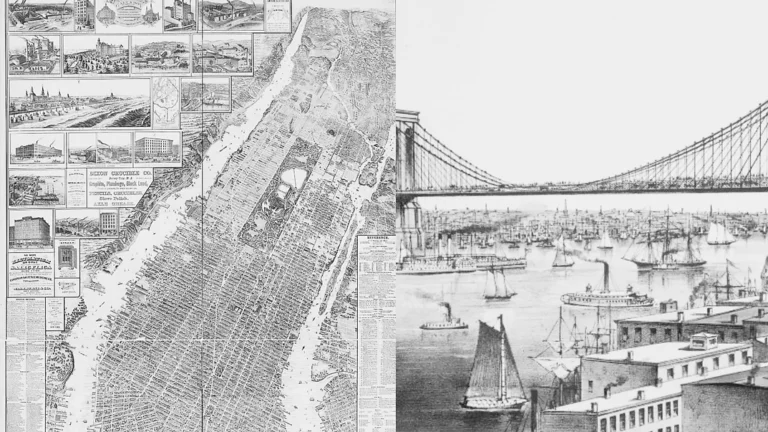

The 19th century, especially after the War of 1812, saw significant urbanization in the United States. As the Industrial Revolution gained momentum, people flocked to cities for jobs, leading to a rapid increase in urban populations. Cities like New York, Chicago, Boston, and Philadelphia proliferated as commerce, manufacturing, and trade centres.

Rising Demand for Housing and Commercial Property:

The influx of people into urban areas created a booming demand for residential and commercial properties. As cities expanded, there was a growing need for organized real estate transactions to manage the buying, selling, and leasing of urban properties. This demand spurred the growth of a more formal real estate market, where professional agents began to play a more significant role.

Speculation in Urban Land:

Just as land speculation had been expected in rural areas during the colonial period, speculation in urban land became increasingly prevalent in the 19th century. Speculators would purchase large tracts of undeveloped land on the outskirts of growing cities, anticipating that these areas would soon become valuable as the cities expanded. Real estate agents and brokers were often involved in these speculative ventures, helping to market and sell these properties to investors and developers.

Emergence of Real Estate Commission Rates and Other Practices

Transition to Professionalization:

As urbanization continued, the complexity of real estate transactions increased. Unlike the earlier, more informal land deals, urban real estate transactions often involved multiple parties, legal contracts, and significant sums of money. This complexity drove the need for more formalized real estate practices, leading to the emergence of the real estate agent as a recognized profession.

Role of Real Estate Agents:

By the mid-19th century, real estate agents began to specialize in various aspects of the real estate market, such as residential sales, commercial leasing, and property management. These agents were typically paid on a commission basis, earning a percentage of the sale or lease price. Their role included advising clients, marketing properties, negotiating deals, and ensuring that transactions were legally sound.

First Real Estate Boards

The New York Real Estate Board (1847)

Formation and Purpose:

The establishment of the New York Real Estate Board in 1847 was a significant milestone in the history of real estate in the United States. This board was one of the first organized efforts to bring order and professionalism to the burgeoning real estate industry. It was founded by prominent real estate professionals in New York City who recognized the need for standardized practices, ethical guidelines, and a unified voice for the industry.

Standardization of Practices:

One key function of the New York Real Estate Board was to standardize real estate practices in a rapidly growing and increasingly competitive market. The board sought to establish consistent methods for appraising property values, setting commissions, and conducting transactions. This helped reduce disputes and increase trust between buyers, sellers, and agents.

Ethical Standards and Advocacy:

The board also played a crucial role in promoting ethical standards among real estate professionals. Members were expected to adhere to a code of conduct emphasising honesty, transparency, and fairness in dealings with clients and other agents. Additionally, the board advocated for the real estate industry, lobbying for favourable legislation and regulations at the local and state levels.

Spread of Real Estate Boards

Expansion to Other Cities:

The success of the New York Real Estate Board inspired the creation of similar organizations in other major cities across the United States. By the late 19th century, real estate boards had been established in cities like Chicago, Boston, and Philadelphia. These boards served as local hubs for real estate professionals, offering networking opportunities, education, and resources to help agents navigate the complexities of the urban real estate market.

Impact on the Industry:

Forming real estate boards was instrumental in transforming real estate from a largely unregulated, informal practice into a more structured and professional industry. These boards laid the groundwork for the eventual creation of the National Association of Real Estate Exchanges in 1908, which later became the National Association of Realtors (NAR). The NAR would go on to play a central role in defining and regulating the real estate profession nationwide.

Unregulated Nature of the Market

Challenges of the 19th Century Market:

Despite the efforts of real estate boards to standardize practices, much of the 19th-century real estate market remained unregulated. There were no federal or state licensing requirements for real estate agents, meaning virtually anyone could call themselves a real estate agent. This lack of regulation led to a wide variance in the quality of service provided by agents, and instances of fraud and unethical behaviour were not uncommon.

Reliance on Personal Reputation:

In this environment, an agent’s success was often heavily dependent on their reputation and community connections. Trust was a critical factor in real estate transactions, and agents known for their integrity and expertise were likelier to succeed. Conversely, those who engaged in dishonest practices could quickly be ostracized from the market.

Transition to the 20th Century

Movement Toward Regulation:

As the 19th century ended, there was growing recognition of the need for formal regulation of the real estate industry. This included establishing licensing requirements, creating professional standards, and enforcing ethical guidelines. These efforts were driven in part by the real estate boards established in the major cities, which sought to protect the profession’s integrity and ensure that only qualified individuals could act as real estate agents.

Foundation for Modern Real Estate Practice:

The developments of the 19th century laid the foundation for the modern real estate industry. The growth of urbanization, the emergence of professional real estate agents, and the creation of real estate boards were all critical steps in the evolution of real estate representation in the United States. These trends would continue to shape the industry in the 20th century and beyond, as real estate became an increasingly essential and regulated sector of the American economy.

Summary

The 19th century was a transformative period for real estate in the United States, marked by urbanization and the increasing demand for property in growing cities. This era saw the emergence of professional real estate practices and the formation of the first real estate boards, which played a crucial role in standardizing the industry and promoting ethical standards. Although the market remained largely unregulated, the foundations laid during this time would pave the way for the more formalized and professional real estate industry that developed in the 20th century.

Real Estate Agent Compensation in the 19th Century

In the 19th century, real estate compensation in the United States evolved as the industry began to formalize, particularly with the rise of urbanization and the establishment of real estate boards. Here’s a detailed look at how real estate agents were compensated during this period:

Early to Mid-19th Century Commission-Based Compensation

Emergence of Commission Structures:

As the real estate market grew more complex with urbanization, commission-based compensation became more common. Real estate agents typically earned a percentage of the sale price of the property they helped to buy or sell. However, unlike the more standardized commissions of the 20th century, these rates were often negotiated individually for each transaction.

Typical Commission Rates:

There was no standard commission rate during the early to mid-19th century, but rates generally ranged from 1% to 5% of the sale price, depending on the difficulty of the sale, the value of the property, and the agreement between the agent and the client. Agents might lower their commission rates in more competitive markets to attract business.

Informal and Flexible Arrangements:

Because the industry was still relatively unregulated, these commission agreements were often informal, sometimes even verbal. Trust and personal reputation played a significant role in these arrangements, with agents relying on their relationships with clients and other professionals.

Flat Fees

Fixed Payment for Services:

In some cases, especially in smaller towns or for more straightforward transactions, agents were paid a flat fee rather than a commission. This fee was agreed upon before the transaction and could vary depending on the complexity of the sale and the local market conditions.

Examples of Flat Fees:

A flat fee might be a set dollar amount, such as $50 or $100, a considerable sum at the time. This fee structure was more common in regions where property values were lower, or transactions were less complex.

In-Kind Compensation

Barter and Trade:

In rural areas or less developed markets, agents might be compensated through barter or trade rather than cash. For example, an agent might receive a portion of the land they helped to sell, livestock, or other goods in exchange for their services. This type of compensation was more common in frontier areas or among smaller, community-based transactions.

Land as Payment:

In some speculative ventures, agents were compensated with land rather than money. For example, they might receive a parcel of land as part of their compensation for selling a larger tract. This was particularly common in regions where cash was scarce, and the land was abundant.

Late 19th Century Standardization of Commissions

Impact of Real Estate Boards:

As real estate boards were established in major cities during the late 19th century, they began to advocate for more standardized practices, including commission rates. These boards helped to create more consistency in how agents were compensated, although there was still significant variation depending on the market and the specific deal.

Adoption of Common Rates:

By the end of the 19th century, it became more common for real estate boards to suggest or recommend standard commission rates, often around 3% to 6% of the sale price. These rates were still subject to negotiation, but they provided a benchmark that helped to professionalize the industry.

Shared Commissions

Cooperation Among Agents:

As the real estate market became more interconnected, agents collaborated more frequently, sharing listings and clients. This led to the practice of splitting commissions between the listing agent (representing the seller) and the selling agent (representing the buyer). This practice encouraged cooperation and increased the likelihood of successful transactions.

Multiple Listing Services (MLS):

While the formal MLS system did not fully develop until the 20th century, the late 19th century saw the beginnings of shared listings and commission agreements among agents in larger cities. This early cooperation laid the groundwork for the more structured MLS systems that would later emerge.

Retainers and Advances

Upfront Payments:

Agents might sometimes receive a retainer or advance payment for their services, particularly in more complex or speculative deals. This payment is deducted from the final commission after the sale is completed. This practice was more common in larger cities or transactions involving high-value properties.

Professionalization and Legal Framework

Increased Legal Oversight:

By the late 19th century, there was growing legal oversight of real estate transactions, particularly in urban areas. This increased the formalization of compensation agreements, making written contracts more common.

Licensing and Regulation:

Although formal licensing of real estate agents would not become widespread until the 20th century, the late 19th century saw the beginning of efforts to regulate the industry, mainly through the activities of real estate boards. This led to more consistent and reliable compensation practices, reducing the likelihood of disputes.